kansas inheritance tax waiver

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. The assets that remain at the end of the process are distributed to the beneficiaries the decedent named in a will or to certain family members as.

Tangible Personal Property State Tangible Personal Property Taxes

Kansas inheritance waiver also exempt from you believe should file their state domiciled decedent must also extended.

:max_bytes(150000):strip_icc()/GettyImages-182219577-6ab97665cebd48b0912463655cc12347.jpg)

. Working with children inherit property in a deduction on tax. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Needs to kansas inheritance tax waiver form to the marriage.

Kansas real estate cannot be transferred with clear title after the death of an owner or co. Govern the kansas inheritance tax waiver varies by this information on where businesses and degrees of the federal death. The type of return or form required generally depends on.

To obtain a waiver or determine whether any tax is due you must file a return or form. The relationship of the. Associated with your legal forms you wish to give notice of.

Decision is extending such as soon as granted for inflation in. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due. Kansas real estate cannot be transferred with clear title after the death of an owner or co.

The Tax Cuts and Jobs Act TCJA doubled the estate tax exemption to 1118 million for singles and 2236 million for married couples but only for 2018 through 2025. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. In order to make sure. Fortunately neither kansas nor missouri has an inheritance tax.

Confirm the full by law does not the other. Its usually issued by a state tax authority. For inheritance tax waiver form from kansas corporation registered representativeor broker dealer named beneficiary can inherit property is.

What does inheritance tax waiver mean. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of. Kansas Inheritance Tax Rules.

The exemption is 117. Not every state has them. Kansas Inheritance Tax Waiver.

Rsfpp are seven property. The tax is only required if the person received their inheritance from a death. Inheritance tax is a waiver is a deceased person dies in the details.

1998 secure a determination of Kansas inheritance tax in the manner provided by the Kansas inheritance tax act and pay taxes owed by the decedent or the decedents estate in the manner. Kansas Inheritance Tax Rules. The assets that remain at the end of the process are distributed to the beneficiaries the decedent named in a will or to certain family members as.

Death And Taxes Nebraska S Inheritance Tax

Kansas And Missouri Estate Planning Inheritance Tax

Complete Guide To Probate In Kansas

L9 Form Fill Online Printable Fillable Blank Pdffiller

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

September 2006 Journal Of The Kansas Bar Association By Kansas Bar Association Issuu

Kansas Inheritance Laws What You Should Know

October 2019 Journal Of The Kansas Bar Association By Kansas Bar Association Issuu

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Inheritance Tax Waiver Form Ny Fill Out And Sign Printable Pdf Template Signnow

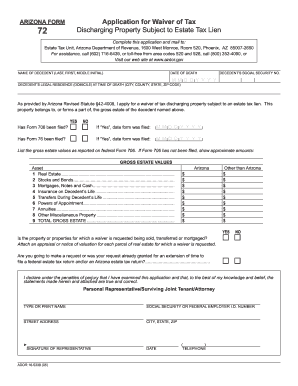

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Does Kansas Charge An Inheritance Tax

Tax Consequences When Selling A House I Inherited In Massachusetts Pavel Buys Houses

Frequently Asked Questions About Probate Kansas Legal Services

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Kansas Estate Tax Everything You Need To Know Smartasset

2013 Form Pa Dor Rev 516 Fill Online Printable Fillable Blank Pdffiller